tax reduction strategies for high income earners australia

This is a tax-effective strategy because super contributions are taxed at the concessional rate of 15 in Australia. This is also called salary packaging and it works a few different ways.

Here are the 5 tax deductions for high earners plus a 6th tax hack at the end of the post.

. There are plenty of opportunities for high-income earners to reduce their tax burden. Here are some of the most accessible tax reduction strategies that ATO allows. These penalties can range from fines to imprisonment for more.

With the Medicare levy already legislated to increase from 15 to 2 from 1 July 2014 the rise in levies will effectively be 25 for. For those trying to learn how to save tax in Australia salary sacrificing is one way to do it. In todays episode Nicholas Olesen CFP CPWA shares the top tax reduction strategies we have advised executives and other high-income earners to take advantage of.

Take Home Rates for an annual income of 400000. Tax avoidance and evasion on the other hand is illegal and attracts heavy penalties from the Australian Tax Office ATO. When you make a concessional contribution into your super account however you only pay a 15 tax rate.

ATO allows individuals to reduce their tax on salary by claiming deductions on work-related expenses that were not reimbursed by the employer. Taxes is probably the one thing just about everyone feels they pay too much of. One of the best ways that you can lower your taxable income is through pre-tax retirement contributions.

High Income Financial Planning Reduce Tax and Build Wealth. Investing in lower income earning spouses name may be better. The first way you can reduce your taxable income and therefore your tax on that income is through additional superannuation contributions.

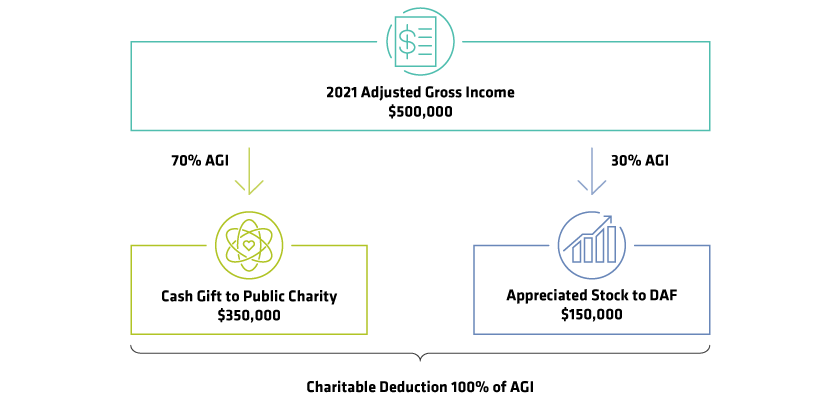

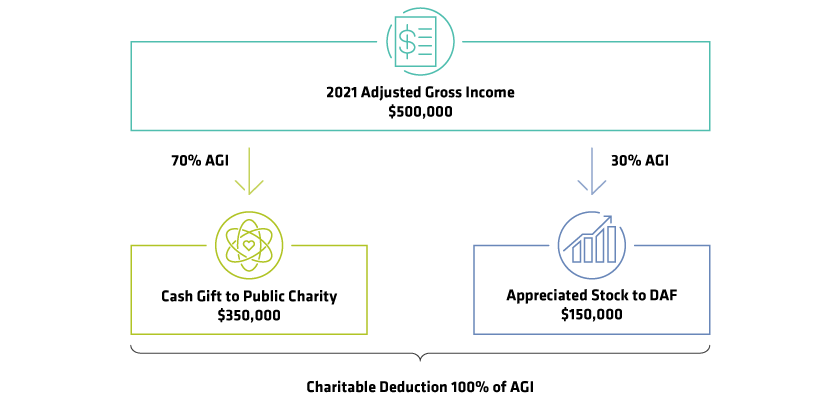

You can currently claim up to 25000 as a tax. Estate and gift exemptions increasing equity exposure charitable donations health savings social security and Medicare buying municipal bonds tax loss harvesting and more. Because of the way Australias income tax system is structured moving.

High Income earner in Australia have the most to gain from the financial rules and investment options if they have the right advice. If your total income was 88000 and you made more than 1000 in deductions you would move down to a lower tax bracket. If you are a high-income earner it is sensible to implement tax minimisation strategies.

Tax reduction strategies. The higher your tax bracket the higher the benefits are of tax savings. The SECURE ACT includes several key changes that affect tax reduction strategies for high-income earners.

TAX REDUCTION STRATEGIES FOR HIGH-INCOME EARNERS IN AUSTRALIA. High-income earners will gain two-fifths of the Coalitions tax cuts in 2020-21 rising to more than four-fifths in 2021-22 according to the Australia Institute. Most of our Sydney clients are in the top 15 of earners in Australia.

With salary sacrificing a taxpayer would put some of their pre. In many cases the tax savings can be tens of thousands even hundreds of thousands of dollars in a very short period of time. For executives and high-income earners it is by far the largest expense they pay each year and for many it.

The age for Required Minimum Distributions or RMDs was raised to 72 from 70-½ in 2020 although if you turned 70-½ in 2019 you still needed to start RMDs in 2020. Exploring tax savings through depreciation superannuation SMSFs and capital gains tax reductions are just. Many Australian Tax Videos Are Discuss The Same BORING Strategies.

August 12 2014. I Have Dug Deeper Into Ways Middle To Upper Income Tax Payers May Reduce Tax Income Tax. Effective tax planning with a qualified accountanttax specialist can help you to do that.

According to an analysis of countries around the world by Price Waterhouse Cooper Australia is ranked nearly at the top of tax rates for high-income earners. With the budget announcement of a temporary 2 budget repair levy for taxable incomes above 180000 those who will be affected may wish to consider some planning strategies to lessen the impact. Alright now that youve got the basics.

As a refresher for 2021 fy the individual tax rates including medicare levy are. One allowable tax deduction that can also be a significant long-term wealth creation strategy is maximising your voluntary superannuation contributions. This rate is lower than the personal income tax rate.

The extra 15 tax imposed under the Division 293 rules is applied because as a high-income earner your marginal tax rate without the 2 Medicare levy for income amounts over 180000 is 45 in 202122. In Australia the tax laws make it so that the highest earners of the country are taxed at unbelievably high rates. Tax reduction strategies for high income earners australia.

Specifically important numbers for 2022 include.

Proposed Tax Changes For High Income Individuals Ey Us

Enhancing The Efficiency And Equity Of The Tax System In Israel Oecd Economic Surveys Israel 2020 Oecd Ilibrary

Rhame Gorrell Wealth Management The Woodlands Tx Home Facebook

Why 5 Million Is Barely Enough To Retire Early With A Family

Enhancing The Efficiency And Equity Of The Tax System In Israel Oecd Economic Surveys Israel 2020 Oecd Ilibrary

Enhancing The Efficiency And Equity Of The Tax System In Israel Oecd Economic Surveys Israel 2020 Oecd Ilibrary

Enhancing The Efficiency And Equity Of The Tax System In Israel Oecd Economic Surveys Israel 2020 Oecd Ilibrary

Medicare Part B Premiums To Rise 2 7 In 2021 With Premiums For Highest Income Couples Topping 12 000 A Year

Enhancing The Efficiency And Equity Of The Tax System In Israel Oecd Economic Surveys Israel 2020 Oecd Ilibrary

Enhancing The Efficiency And Equity Of The Tax System In Israel Oecd Economic Surveys Israel 2020 Oecd Ilibrary

Your Complete Guide To The 2018 Tax Changes The Motley Fool

Australia 2021 Article Iv Consultation Press Release Staff Report And Statement By The Executive Director For Australia In Imf Staff Country Reports Volume 2021 Issue 255 2021

How Much Of Your Pre Retirement Income Will Social Security Replace The Motley Fool

Why 5 Million Is Barely Enough To Retire Early With A Family

The Gift That Keeps On Giving Tax Breaks Renewed For 2021 Context Ab

:strip_icc()/how-do-401k-tax-deductions-work-90f14263254d470fb07b75f2bf664174.png)